As a key driver of manufacturing and technological progress, bourgeois economists are paying increasing attention to the development and manufacture of the new generations of semiconductor microprocessors, and they are not alone. The legislators and ruling class of the chief imperialist powers, in particular the USA and Britain, ever keen to stifle the rise of China as an economic competitor, are seeking to leverage their technological advantage in this field to preserve their otherwise ebbing global economic and military hegemony.

“A world war was declared on 7 October [2022]. No news station reported on it, even though we will all have to suffer its effects. That day, the Biden administration launched a technological offensive against China, placing stringent limits and extensive controls on the export not only of integrated circuits, but also their designs, the machines used to ‘write’ them on silicon, and the tools these machines produce. Henceforth, if a Chinese factory requires any of these components to produce goods – like Apple’s mobile phones, or GM’s cars – other firms must request a special licence to export them.

“Why has the US implemented these sanctions? And why are they so severe? Because … [chips] are part of … everything China makes – from cars to phones, washing machines, toasters, televisions and microwaves. That’s why China uses more than 70 percent of the world’s semiconductor products, although contrary to common perception it only produces 15 percent. In fact, this latter figure is misleading, as China doesn’t produce any of the latest chips, those used in artificial intelligence or advanced weapons systems.” (Circuits of war by Marco d’Eramo, New Left Review, 14 November 2022)

The semiconductor industry lives – and dies – by a simple creed: smaller, faster and cheaper.

Success in the semiconductor industry depends on creating smaller, faster and cheaper products.

The benefit of transistors being tiny is that more processing power can be placed on a single chip, and in a smaller space. The more transistors on a chip, the faster the chip can do its work. This creates fierce competition in the industry and new technologies lower the cost of production per chip.

Manufacturing and the economy of scale

Currently, microchips rely on the fine printing or etching of transistor circuitry into integrated chip designs, with ever smaller transistor components on layers of meticulously crystallised wafer-thin silicone.

The technology to perform this fine printing is itself incredibly intricate, specialised and expensive, as the size of the individual transistor units within the integrated circuitry has been sequentially decreased to the hundreds and then tens of nanometres (one nanometre is one billionth of a metre, or 1×10-9m).

Monopoly and outsourcing microchip production

“The microchip industry is distinguished by its geographical dispersal and financial concentration. This is owed to the fact that production is extremely capital intensive. Moreover, its capital intensity accelerates over time, as the industry’s dynamic is based on a continuous improvement of ‘performance’: ie, of the capacity to process ever more complex algorithms whilst reducing electricity consumption.

“The first solid integrated circuits developed in the early 1960s had 130 transistors. The original Intel processor from 1971 had 2,300 transistors. In the 1990s, the number of transistors in a single chip surpassed one million. In 2010, a chip contained 560 million, and a 2022 Apple iPhone has 114 billion.

“Since transistors are always getting smaller, the techniques for fabricating them on a semiconductor have become increasingly sophisticated; the ray of light which tracks designs must be of a shorter and shorter wavelength. The first rays used were of visible light (from 700 to 400 billionths of a metre, nanometres, nm). Over the years this was reduced to 190nm, then 130nm, before reaching extreme ultraviolet: only 3nm. For scale, a Covid-19 virion is around ten times this size.

“Highly complex and expensive technology [extreme ultraviolet lithography] is necessary to attain these microscopic dimensions: lasers and optical devices of incredible precision as well as the purest of diamonds. A laser capable of producing a sufficiently stable and focused light is composed of 457,329 parts, produced by tens of thousands of specialised companies scattered around the world (a single microchip ‘printer’ with these characteristics is worth $100m, with the latest model projected to cost $300m).

“This means that opening a chip factory requires an investment of around $20bn, essentially the same amount you would need for an aircraft carrier. This investment must bear fruit in a very short amount of time, because in a few years the chips will have been surpassed by a more advanced, compact, miniaturised model, which will require completely new equipment, architecture, and procedures.

“(There are physical limits to this process; by now we’ve reached layers just a few atoms thick, which is why there’s so much investment in quantum computing, in which the physical limit of quantum uncertainty below a certain threshold is no longer a limitation, but a feature to be exploited.)

“This speaks to the paradox at the heart of our technological modernity: increasingly infinitesimal miniaturisation requires ever more macroscopic, titanic facilities, so much so that the Pentagon can’t even afford them, despite its annual budget of $700bn.

“There are only two real giants in material production: one is Samsung of south Korea, favoured by the US during the 1990s to counter the rise of Japan ..; the other is TSMC (Taiwan Semiconductor Manufacturing Company) … which produces 90 percent of the world’s advanced chips …

“The USA [seeks to] effectively block Chinese technological progress because no country in the world [currently] has the competence or resources necessary to develop these sophisticated systems [in isolation]. The US itself must rely on technological infrastructure developed in Germany, Britain and elsewhere. Yet this is not merely a question of technology; trained engineers, researchers and technicians are also necessary. For China, then, the mountain to climb is steep, even vertiginous. If it manages to procure a component, it will find that another is missing, and so on. In this sector, technological autarky is impossible.” (Ibid)

Silicone chip sanctions – the war has begun

As if suddenly waking up to the reality of the implications of outsourcing production, the US administration has realised that “America’s edge is slipping, undermined by competitors in Taiwan, Korea, Europe, and, above all, China … China, which spends more money each year importing chips than it spends importing oil, is pouring billions into a chip-building initiative to catch up to the US. At stake is America’s military superiority and economic prosperity …

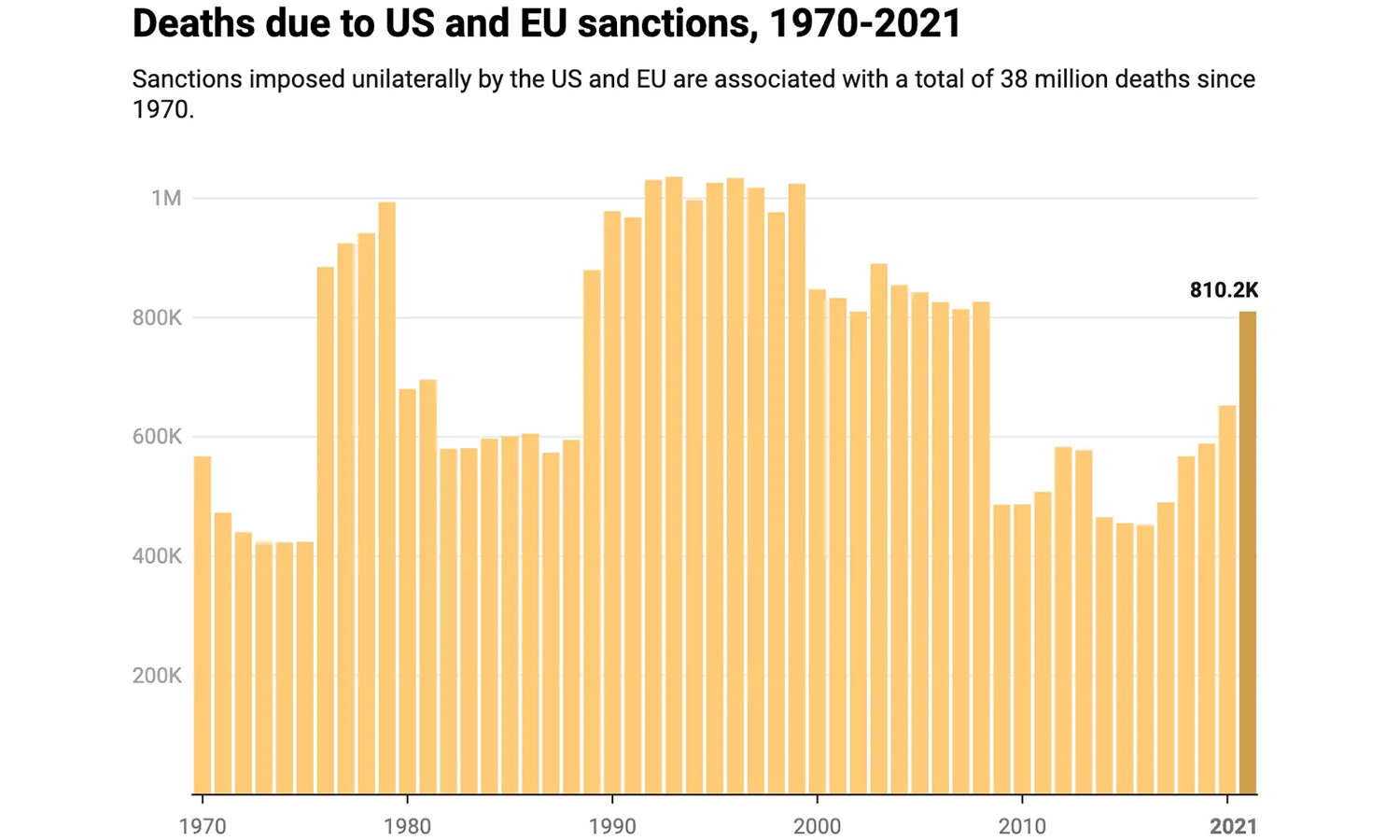

“Chip development and production is now the key area in the US attempt to isolate, weaken and reduce the economic and military power of China and other countries that deem to oppose US global interests. In the past, the US has used the power of the dollar to cut adversaries off from global finance. The new US Chips Act aims to isolate Russia and China from the world’s tech economy and stymie their military capabilities.” (Chips: the new arms race, Michael Roberts blog, 11 December 2022)

Of course, like the oil sanctions on Russia, this economic warfare will have profound consequences for US and western imperialism, quite possibly greater negative economic impact than their effect on China.

Firstly, cutting China off from advanced chips manufactured outside her borders – assuming that this will ultimately prove possible – would have a profound effect on global supply chains and consumer prices. And this in a world that already is reeling from the prolonged effect of an overproduction crisis exacerbated by the sanctions war on Russia.

Secondly, the relocation of American industries to China has been, and remains, a source of immense profit for American finance kings, who will have a great deal to lose as a result of having to move out. Moreover, “US chip sanctions would hit the production and profits of US companies, with some estimating that it could reduce US global market share 18 percent and hit 37 percent of their revenue in the long term”. (Ibid)

Also, although Biden hopes to implement the policy of ‘Make America great again’ by relocating exported industries back to the USA, this plan is largely unfeasible under the conditions of capitalism.

“Two months prior to the announcement of microchip sanctions on China, the Biden administration launched a Chip and Science Act which allocated $50bn to the repatriation of at least part of the production process, practically forcing Samsung and TSMC to build new manufacturing sites (and upgrade old ones) on American soil. Samsung has since pledged $200bn for 11 new facilities in Texas over the next decade – although the timeline is more likely to be decades, plural.

“All this goes to show that if the US is willing to ‘deglobalise’ some of its productive apparatus, it’s also extremely difficult to decouple the economies of China and the US after almost 40 years of reciprocal engagement. And it will be even more complicated for the US to convince its other allies – Japan, south Korea, Europe – to disentangle their economies from China’s, not least because these states have historically used such trading ties to loosen the American yoke.” (Marco d’Eramo, op cit)

Thirdly, the attempt to hold China back is unlikely to work for long: the Chinese have been investing huge sums to make good the technology gap and increase their independent domestic ability to produce advanced integrated semiconductor circuits – particularly chastened by the sanctions previously experienced around its Huawei telecoms industry. (New sanctions deal ‘lethal blow’ to Huawei. China decries US bullying by Sherisse Pham, CNN Business, 17 August 2020)

“China-located chip production could increase to 21.2 percent of China’s demand by 2026 from 16.7 percent in 2021.” (Michael Roberts, op cit)

Moreover: “‘The pace at which Chinese chipmakers have caught up is much faster than anyone expected when it comes to market share of older chips,’ says Donghwan Kim, chief executive of Hana Ventures, a tech-focused venture capital firm.” (The cost of America’s ban on Chinese chips by June Yoon, Financial Times, 24 November2022)

Social relations remain our fundamental problem

“Constant revolutionising of production, uninterrupted disturbance of all social conditions, everlasting uncertainty and agitation distinguish the bourgeois epoch from all earlier ones. All fixed, fast-frozen relations, with their train of ancient and venerable prejudices and opinions, are swept away, all new-formed ones become antiquated before they can ossify.

“All that is solid melts into air, all that is holy is profaned, and man is at last compelled to face with sober senses his real conditions of life, and his relations with his kind.” (K Marx and F Engels, The Communist Manifesto, 1848)

Technology in and of itself has not supplanted exploitation. The revolution in computing technology, under current relations of production, has to an extent reinforced them. Long before the advent of the IT revolution, VI Lenin noted that all that was necessary for the transformation of the economy was the social ownership of the means of production and accounting in the hands of the workers themselves.

Computing and the semiconductor have unquestionably increased the power of production and the ease with which workers will be able to administer their own affairs – once they are the ruling class.

Without a doubt, these advances in the means of production are paving the way for great advances under socialism. In the meantime, while imperialism lasts, the battle for technology is having an unforeseen impact on the balance of power, cutting the ground from under the feet of the western imperialists.