On the 7 July this year, Greece held parliamentary elections. In these elections the supposedly radical-left Syriza party, which has been in government since 2012, was defeated, securing only 31.53 percent of the vote – entitling it to 86 seats, as compared to the 145 it had previously. In its stead, the right-centrist New Democracy party was elected with an absolute, if narrow, majority in parliament, on the basis of having received 39.85 percent of the vote entitling it to 158 of the 300 seats – a big increase over the 75 it held previously.

Given that the Syriza government had presided over seven years of the most vicious creditor-imposed austerity, it is not at all surprising that it found itself on its bike. What is less clear is why the Greek electorate would have wanted to return a party to government that is openly pro-business and openly committed to saving money by sacking government workers, among many other anti-worker policies.

In all this, the Greek Communist party made neither losses nor gains, receiving some 5 percent of the vote, giving it the same 15 parliamentary seats that it had before. At the same time, the radical right-wing party Golden Dawn lost so much support that it is no longer entitled to send a single representative to parliament. This is partly because New Democracy has adopted much of its anti-immigrant agenda, and partly because it has had to share the radical-right vote with another similar party, Golden Solution, which obtained 3.7 percent of the vote and gained 10 seats.

It would unfortunately seem that the voters who abandoned Syriza did not turn in any significant way to the Communist party (KKE). A few of them went to the new party set up by Yanis Varoufakis, with the unlikely name of MeRA25, which received 3.44 percent of the vote, entitling it to nine seats.

It will be recalled that Varoufakis split with Syriza when the latter failed to respect the result of a referendum held in 2015, when the Greek people rejected the terms of a proposed European bailout of the economy. However, even if the Varoufakis party votes were added to those secured by Syriza, the Greek left-populist side still suffered a humiliating defeat.

Austerity blamed on the left

What the European bankers have achieved is to get the parties with the most left-looking agendas to take the blame for the years of vicious austerity imposed on the people of Greece by their country’s predatory creditors. Thus it was that, in the hope of returning to normal economic activity, the electorate ‘freely’ choose a ‘safe pair of hands’ – ie, a party that is less reluctant in protecting the interests of finance capital.

Some bourgeois pundits are even prepared to praise Syriza’s leader, Alexis Tsipras, for the admirable work he has done in satisfying the financiers’ agenda: “New Democracy will benefit from the relative economic stability following eight years of international bailout programmes,” admits the editorial board of the Financial Times. (Mitsotakis faces big hurdles to reform Greece, 9 July 2019)

The New York Times also showered Tsipras with the faintest of praise: “Mr Tsipras did manage to restore a semblance of stability to Greece’s economy, which is growing today, though only at a tepid 2 percent …

“Mr Tsipras also pushed through some privatisation. He cut pensions, raised taxes and trimmed spending to meet stringent fiscal targets that demand Greece’s budget runs sizable surpluses for years to come.” (Greek elections: prime minister loses elections to centre right by Matina Stevis-Gridneff, 7 July 2019)

And the Financial Times was almost ecstatic, declaring:

“Mr Tsipras reneged on his promise to defy austerity but still won re-election a few months later, a victory that encouraged him to moderate. He stuck by demanding fiscal targets, running a primary surplus of 3.5 percent of gross domestic product until resorting to pre-election giveaways this year. He pushed through some important reforms. The economy stabilised, investor confidence returned and Greece exited its third bailout programme last year.

“Mr Tsipras regained the trust of his EU partners …” (Kyriakos Mitsotakis has long road ahead to complete Greek revival by Ben Hall, 8 July 2019)

But despite thus recognising Tsipras’s usefulness to finance capital, nevertheless both the Financial Times and the New York Times have made it clear that the European bourgeoisie is glad to see the back of him:

“There will be satisfaction in EU circles that Greece is swinging back from the populist fringe to the political mainstream, especially given the tide running in the opposite direction elsewhere on the continent.” (Financial Times, ibid)

“With an absolute majority in parliament for his New Democracy party, Mr Mitsotakis will be able to cut taxes, sell off state assets and scale back bureaucracy, all with the aim of boosting investment and unleashing animal spirits in the economy,” gushes the same article.

However, such is the enormous damage done to the Greek economy by the austerity years, the Financial Times is far from sure that things can significantly improve – even with a prime minister who, from finance capital’s point of view, is ideal.

The blame for this is being variously attributed to cronyism, corruption and a pampered working class, but the truth is that the blame should be placed firmly on the shoulders of Greece’s creditors.

Wolfgang Munchau of the Financial Times wrote in 2015: “Contrast the two extreme scenarios [then available to Greek prime minister Tsipras]: accept the creditors’ final offer or leave the eurozone. By accepting the offer, he would have to agree to a fiscal adjustment of 1.7 percent of gross domestic product within six months.

“My colleague Martin Sandbu calculated how an adjustment of such scale would affect the Greek growth rate. I have now extended that calculation to incorporate the entire four-year fiscal adjustment programme, as demanded by the creditors. Based on the same assumptions he makes about how fiscal policy and GDP interact, a two-way process, I come to a figure of a cumulative hit on the level of GDP of 12.6 percent over four years.

“The Greek debt-to-GDP ratio would start approaching 200 percent. My conclusion is that the acceptance of the troika’s programme would constitute a dual suicide – for the Greek economy, and for the political career of the Greek prime minister.” (Greece has nothing to lose by saying no to creditors, 15 June 2015)

In actual fact, however, so thorough was Tsipras’ capitulation to the demands of creditors that the economy shrunk not by 12.6 percent but by almost a quarter, making it ever more difficult to service the ever-ballooning public debt. This now stands at 183 percent of GDP, while the Greek banks are still replete with non-performing loans. Unemployment stands at 18 percent – 33 percent among the young.

With such a high proportion of the working population forced into idleness, how can Greece produce the wealth needed to service this massive debt? Essentially, the finance capitalists are having to lend Greece money to enable Greece to service the debt.

Mitsotakis has promised tax cuts and a general easing of austerity, and it was undoubtedly on the basis of these promises that he has been elected, but he does not actually have the wherewithal to deliver on these promises.

“It is not clear that Greece’s creditors in the eurozone and the International Monetary Fund will be keen to give Mr Mitsotakis space to cut taxes as he hopes. Despite formally exiting its bailout programme, Greece is still under strict monitoring until it repays its dues, and has committed to observing stringent fiscal goals that allow the new government little leeway”. (New York Times, op cit)

The condition to which Tsipras was adhering was to maintain a primary fiscal surplus of 3.5 percent (ie, surplus of government income over expenditure, without taking into account debt servicing). According to the Financial Times: “Mr Mitsotakis said during the election campaign that he hoped to renegotiate this target but was rebuffed by eurozone officials on his first day in office.” (Editorial, op cit)

Lessons of the Greek crisis

There is a widespread irrational belief in the working-class and progressive movement that it is possible to make capitalism work for the benefit of working people provided there are decent people in command.

This pipedream avoids all the unpleasantness involved in the inevitably vicious resistance put up by the billionaire ruling classes to being parted from their capital – the massive wealth that they have acquired at the expense of the working class and oppressed peoples of the world.

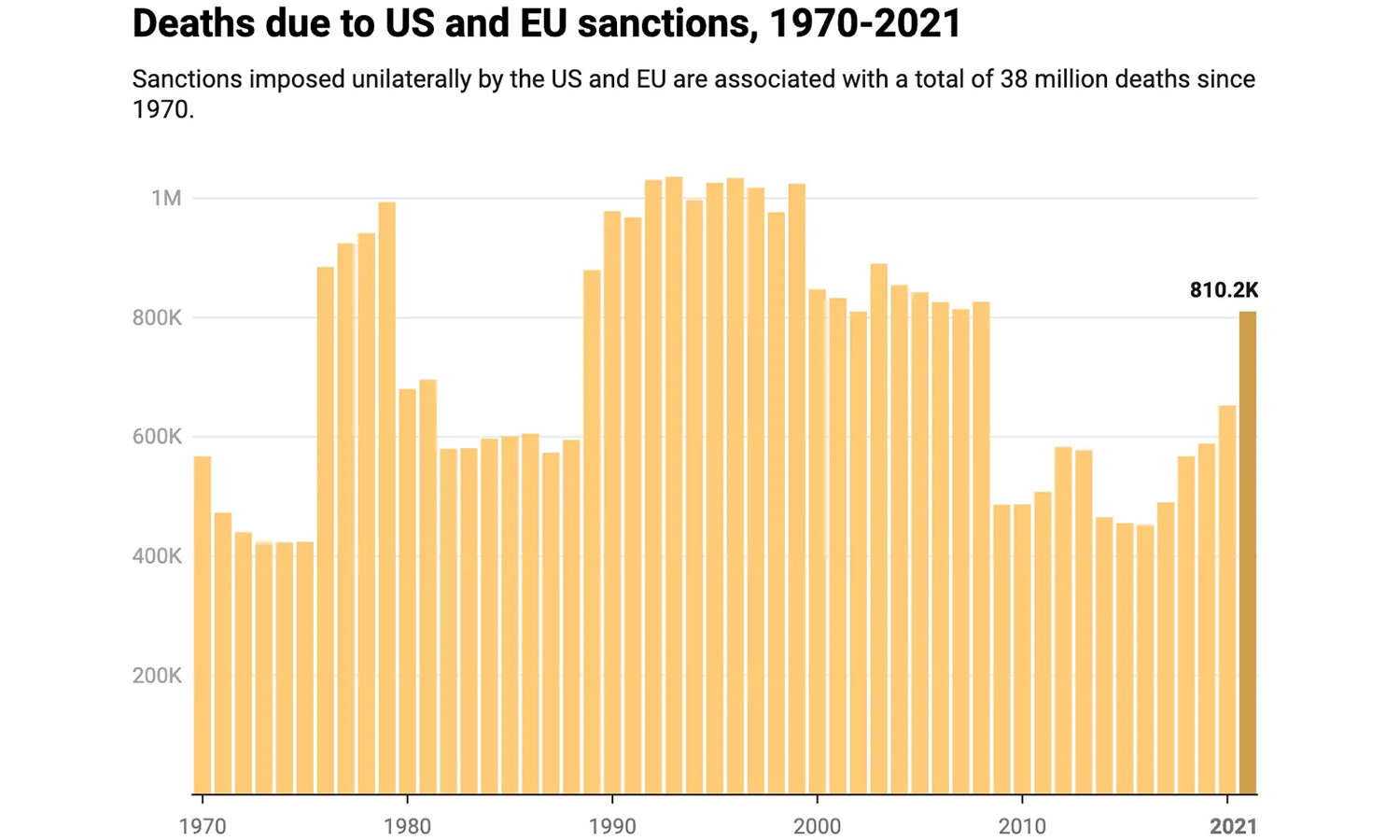

It avoids the unpleasantness involved in the working class holding on to state power when they do achieve it in the face of the ruthless attempts of the erstwhile ruling classes to regain their lost paradise – involving blockades and sanctions to starve the population, sabotage and outright war.

If only it were real, and not a pipedream!

Marxism, however, teaches us that a capitalist economy has its own unshakeable laws, which are just as powerful as the law of gravity that governs the tides.

There are ‘tools’ that bourgeois economists can use to defer the consequences of those laws, just as it is possible to build a wall to hold back the tide. But in the end those measures cannot but crumble in the face of capitalist necessity. Capitalist production is obliged constantly to expand in order to stay still, but the market can never keep pace, leading unfailingly to crises of overproduction.

“We have seen that the ever increasing perfectibility of modern machinery is, by the anarchy of social production, turned into a compulsory law that forces the individual industrial capitalist always to improve his machinery, always to increase its productive force,” explained Friedrich Engels in his seminal work Anti-Dühring. “The bare possibility of extending the field of production is transformed for him into a similar compulsory law. The enormous expansive force of modern industry, compared with which that of gases is mere child’s play, appears to us now as a necessity for expansion, both qualitative and quantitative, that laughs at all resistance.”

However, “Such resistance is offered by consumption, by sales, by the markets for the products of modern industry,” explained Engels. “But the capacity for extension, extensive and intensive, of the markets is primarily governed by quite different laws that work much less energetically.

“The extension of the markets cannot keep pace with the extension of production. The collision becomes inevitable.” Crises ensue. (1877, Chapter 24)

“Overproduction, the credit system, etc, are means by which capitalist production seeks to break through its own barriers and to produce over and above its own limits … Hence crises arise, which simultaneously drive it onward and beyond [its own limits] and force it to put on seven-league boots, in order to reach a development of the productive forces which could only be achieved very slowly within its own limits.” (Karl Marx, Theories of Surplus Value, 1863, Chapter 20)

But, “The whole mechanism of the capitalist mode of production breaks down under the pressure of the productive forces, its own creations,” states Engels. “It is no longer able to turn all this mass of means of production into capital. They lie fallow, and for that very reason the industrial reserve army [the unemployed workers] must also lie fallow. Means of production, means of subsistence, available labourers, all the elements of production and of general wealth, are present in abundance. But ‘abundance becomes the source of distress and want’ (Fourier), because it is the very thing that prevents the transformation of the means of production and subsistence into capital.” (Anti-Dühring, op cit)

These effects may be delayed in manifesting themselves by the generous application of lending and quantitative easing, but in the end the chickens come home to roost. Lending to Greece kept capitalist enterprises booming for years throughout Europe, especially in Germany, but when the latest financial crisis broke out in 2007, Greece could not maintain the servicing of its loans and the sea wall simply collapsed. The European banks rushed in to shore it up with more loans to service the loans that had gone before, but obviously in the end no good could come of it.

The financial press is happy to draw the lesson, up to a point, that parties that are theoretically ‘anti-capitalist’ are nevertheless, if they take power, forced to take account of capitalist reality:

“The election victory on Sunday by a traditional centre-right party was the end of Greece’s flirtation with radical left-wing populist politics, even as the radicals of Mr Tsipras’s Syriza party transformed themselves into a mainstream force of the centre-left.

“The Tsipras experiment may hold important lessons for Europe and its new ranks of anti-establishment populists. While many, as in Italy, gleefully thumb their noses at the European Union and its rules, once in power the risks of following through on their rebelliousness may corral them from the extremes.

“Greece represented a special, wrenching case, but its experience showed that, especially for small countries, if you are in the eurozone, ‘you’re not free to run a radical financial policy’, said Charles Grant, the director of the Centre for European Reform. ‘The combination of EU rules and the financial markets forced a kind of orthodoxy on Greece, and will probably work similarly with Italy.’” (Greece’s experiment with populism holds lessons for Europe by Matina Stevis-Gridneff and Steven Erlanger, New York Times, 9 July 2019)

Obviously the bourgeois financial press is not going to draw the lesson that ‘radical’ parties can only be brought to heel if their sights do not extend beyond capitalism. It is only too true that there are strict limits to the extent that you can mess with the laws of capitalism, but the whole point is that therefore capitalism must go.

Therefore the bourgeois state that exists to defend the capitalist system must be overthrown. Therefore it must be replaced by a proletarian state that sets up and defends the system of the socialist planned economy – which works for the benefit of those who work rather than the profits of the moneybags.

This is the real lesson to be learnt from the Greek debacle.