A large proportion of Britain’s economy is based on international trade. “In 2019, the UK’s total trade (imports and exports) equalled £1.4tn, of which £724.5bn was imports and £698.6bn was exports. Exports as a percentage of GDP was 30 percent”. (World Bank and OECD national accounts data)

Manufacturing, fisheries and farming

More than that, British manufacturing is intimately connected to global supply lines operating on a ‘just-in-time’ basis – ie, stocks are ordered only when they are on the verge of running out in order to minimise the time that capital is tied up in stockpiles awaiting use.

“Last year, £672.5bn (47.3 percent) of the UK’s total trade was with the EU and £750.6bn (52.7 percent) was non-EU. The UK’s top 10 non-EU trading partners include the US, which in 2019 accounted for 15 percent of total trade, China at 5.1 percent, Switzerland at 2.6 percent and Japan at 2.2 percent.

“UNCTAD has calculated that the UK risks losing up to 14 percent of its exports to the EU in the event of a no-deal Brexit, as opposed to only 9 percent if a trade deal is agreed, assuming that a free trade deal with the EU would not address NTBs (non-tariff barriers) such as the harmonisation of health and safety, employment rights, environment protection and food safety standards, which normal FTAs do not normally do.” (Ed Balls, Nyasha Weinberg, Jessica Redmond and Simon Borumand, Will Prioritising a UK-US Free Trade Agreement Make or Break Global Britain?, Mossavar-Rahmani Center for Business & Government at Harvard Kennedy School, May 2020)

Clearly, it is important to the British government to find some way of making up for the projected shortfall of exports to the European Union. It will also want to make good quite significant losses to the country in relation to the very significant additional cost of trading with the EU.

“Her Majesty’s Revenue and Customs, the UK’s tax-collecting agency, estimated that British businesses would spend £15bn ($19.6bn) extra per year on paperwork in the event of a ‘no-deal’ Brexit.” (How Britain and the EU would trade under WTO rules by Bryce Baschuk, Washington Post, 3 February 2020)

This paperwork would apparently include “up to nine documents that would be needed to sell a British product to an EU country [in the event of there being no free trade agreement concluded with the EU]. Under any sort of deal, exports and imports will need a certificate of origin, transit certificates, customs valuation documents and, if exporting to northern Ireland, destination paperwork to ensure goods are not then moved to the EU.

“Without a comprehensive trade agreement, there will need to be other pieces of paper: VAT and excise documents, freight certificates, health and veterinary documents, exit and entry summary declarations, and safety and security permits.” (UK’s hardline Brexit stance starts to sour relations with business by Daniel Thomas, Financial Times, 10 March 2020)

In the circumstances, the British government’s insistence that it is prepared to face the future without a deal with the EU seems somewhat insane. The reason for this insistence is the EU’s intransigent insistence on including in any such deal certain protections for EU producers – what is termed a ‘level playing field’.

It seeks to prevent British producers undercutting European costs of production by reducing employment rights, food safety standards and environmental protection below European standards, or by providing government subsidies that enable British producers to undersell their European competitors. The British argue that no such provisions exist in any of the other free trade agreements that the European Union has negotiated with countries around the world, so why should the UK be singled out?

However, it is easy to see that the sheer volume of trade between Britain and the EU does make it different from all the other non-EU countries with which the EU has dealings. Britain claims it has no intention of lowering standards but does not want to be committed to maintaining them as this would be the kind of incursion against its sovereignty that Brexit seeks to avoid.

There are also arguments around fisheries, since clearly Britain would prefer to have its extensive territorial waters to itself rather than share them with other EU countries, even though the fishing industry represents only 0.9 percent of the British economy. (EU-UK trade talks: four key battle lines for post-Brexit settlement by George Parker, Financial Times, 27 February 2020)

However, the huge advantages to Britain of a free trade agreement with the EU would appear to justify some concessions being made. Both Britain and the EU stand to lose out if no agreement can be reached, but Britain, it is thought, far more so than the EU.

If dealings with the EU have to be under World Trade Organisation (WTO) rules, 10 percent tariffs will automatically come into force on all exports of motor vehicles and aviation products to the EU.

In the case of the former, however, Britain’s motor manufacturers will then have the protection of 10 percent tariffs on vehicles coming in from abroad, so that equivalent foreign-made cars would be some £3,000 more expensive than those locally produced, which might overall mean an increase of sales for British manufacturers.

One assumes, however, that the same would not be true of the products of the aviation industry.

There will also be tariffs on food exports, quite apart from the mountain of paperwork: “The EU’s average most-favoured nation tariff rates are 11.1 percent for agricultural goods, 15.7 percent for animal products and 35.4 percent for dairy.” (Washington Post, op cit)

Since Britain’s exports to other EU member states account for 60-65 percent of its total agricultural exports, with a value of some £14bn (€16bn) slapping on the EU’s heavy WTO tariffs will clearly impact heavily on Britain’s farming industry.

However, Britain has been importing from the EU twice the value of agricultural produce than it has been exporting, so if Britain is left to deal with the EU on WTO terms, it will also apply its own WTO schedule terms to imports from the EU, which is also likely to impact heavily on EU farmers but put farmers from around the rest of the world on a ‘level playing field’ with the EU as far as exporting to the UK is concerned.

The resultant rise in food prices in Britain will considerably make up for the loss of EU exports to British farmers, as they will be able to sell their produce at home not only at a higher price but also in greater quantities. But, of course, it is the consumer who will pay the price.

The service sector

The greatest worry for Britain’s exports if no trade deal is reached with the EU is in relation to the service sector, especially financial services. “Britain’s services providers … collectively make up 79 percent of the UK economy and 45 percent of exports.” (Washington Post, ibid)

Moreover, “Financial services accounted for 6.9 percent of UK gross domestic product in 2018 and future access to the European market is crucial not just for the City of London but to EU consumers and businesses who rely on its deep pool of capital”. (Financial Times, op cit)

As a member of the EU, British service providers could trade throughout the EU as freely as in the UK – establishing headquarters wherever they wanted, moving staff around, etc, and they required no more special permits to trade than they would if their activities were restricted exclusively to the UK.

All this freedom will go at the end of this year. The EU is only prepared to negotiate allowing freedom to export financial services under the principle of ‘equivalence’, which it describes as “a key instrument to effectively manage cross-border activity of market players in a sound and secure prudential environment with third-country jurisdictions that adhere to, implement and enforce rigorously the same high standards of prudential rules as the EU commission”. (Staff working document, EU equivalence decisions in financial services policy: an assessment, 27 February 2017)

The problems with ‘equivalence’, although it seems fair enough on the face of it, are: (1) that separate assessments of ‘equivalence’ have to be made for each and every individual financial service; (2) the EU is the sole judge and jury on the question of whether ‘equivalence’ exists; (3) an ‘equivalence’ assessment can be withdrawn at any time on short notice; and (4) freedom of establishment and of movement of personnel are separate issues that can by no means be guaranteed.

This being the case, it is hard to avoid the conclusion that by leaving the EU, British imperialism has shot itself in the foot in relation to its financial services industry, considerably undermining “London’s fight to remain a global financial hub”. Frankfurt is only too willing to fill the void! (Washington Post, op cit)

It is clear that Britain wants rather more from any free trade agreement with the EU than it is usual for such agreements to cover, since they do not usually deal more than cursorily with trade in services. And since Britain really rather desperately needs its freedom to trade in services in the EU to continue untrammelled, it is not unreasonable for the EU to expect quite major concessions in return.

But of course major concessions are an anathema to the Brexiteer, who sees the whole process as returning sovereignty to the UK and would be horrified to find this ‘sovereignty’ compromised in any way.

Press reaction to a no-deal Brexit

Despite these undoubted difficulties, and despite the disruption being caused by the coronavirus pandemic, the British government has proudly announced that it does not wish to extend the period within which any free trade agreement with the EU must be concluded beyond the end of this year.

It is all ready for its ‘no-deal’ Brexit, a position much lauded by such sections of the press as the Telegraph and desperately decried by the Financial Times.

Ambrose Evans-Pritchard of the Telegraph, normally a most sober economic analyst, is in raptures over the prospect of a no-deal Brexit. After accusing the EU of stifling innovation through an ingrained policy of risk aversion, he goes on to say:

“The question Britain must grapple with as it seeks to shape its destiny for the next fifty years is whether it wishes to stay with to the Cartesian, top-down, deductive method of Europe, or return to the bottom-up, free-thinking empiricism of Bacon, Locke, Hume, Smith and Darwin, the marvel of Britain’s best three centuries, and which so binds us to America, the Anglosphere, and, for that matter, India.” (Our Brexit destiny in the 21st century is a watershed philosophical choice, far beyond immediate trade, 31 January 2020)

This is quite a contrast with Martin Wolf of the Financial Times:

“The idea seems to be that, in the midst of the pandemic, nobody would notice the additional disruption imposed by an overnight break in economic relations with the country’s most important partners and eternal neighbours. Here are seven reasons why this is a disgraceful idea.

“First, it is not what the leave campaign actually promised. The country was repeatedly told it would be easy to secure an excellent free trade agreement, because it held ‘all the cards’ …

“Second, the notion of some economists that Brexit would lead to unilateral free trade has also proved a fantasy. The UK has published a tariff schedule that is far from free trade … The political economy of trade and the need to preserve some tariffs for use as negotiating chips in future trade deals made this outcome almost inevitable.

“Third, the UK is breaking its word. In order to reach his exit deal last October, Mr Johnson agreed that northern Ireland would remain in the EU’s customs area and single market. But standard customs and regulatory checks must be imposed in the Irish Sea if the EU’s customs area and single market is not to be vulnerable to trans-shipment via the UK. Either Mr Johnson does not understand this, which would be stupid, or he does, which means he has wittingly lied.

“Fourth, the political declaration accompanying October’s exit agreement stated that: ‘Given the Union and the UK’s geographic proximity and economic interdependence, the future relationship must ensure open and fair competition, encompassing robust commitments to ensure a level playing field … In so doing, they should rely on appropriate and relevant Union and international standards, and include appropriate mechanisms to ensure effective implementation domestically, enforcement and dispute settlement (my emphases).’ Thus, EU demands were known and accepted by the UK.

“Fifth, the globalising world economy assumed by leave in the referendum campaign no longer exists. The world trading system is under mortal threat, given the breakdown in relations between the US and China and the neutering of the World Trade Organisation in both its judicial and legislative functions. A ‘global Britain’ will not emerge, but one seeking crumbs from the tables of more powerful trading powers, themselves engaged in vicious squabbling.

“Sixth, we are in the grips of a pandemic-induced depression of vast magnitude and unknown duration. It is a good bet that, at the end of 2020, the UK economy will still be very depressed, with damaged businesses and frighteningly high unemployment. That would hardly be a good time to add to the shocks already crippling the economy.

“Finally, the longer-run outcomes of the pandemic will probably include permanently lower output, as happened after the financial crisis of 2007-8. Over and above that will now come a huge trade shock from an ultra-hard Brexit. The consensus of professional opinion is that the lost trade opportunities would lead to substantial long-term reductions in levels of productivity and output. These losses will now add to the losses from the pandemic.” (A no-deal Brexit amid the pandemic would be disgraceful, 21 May 2020)

Martin Wolf would appear not to subscribe to the solution upon which both British trade secretary Liz Truss and his fellow journo Ambrose Evans-Pritchard are placing their faith: a comprehensive free trade agreement with the United States, which US president Donald Trump has suggested will be a “very big trade deal”, signalling great enthusiasm.

However, it would seem probable that financial services are off the table, as are motor cars – just for starters. Remember that for Trump it’s America First: his anxiety is to open up markets abroad for American farmers and multinationals, and the concept of giving anything away in exchange amounts to a total anathema for him – and, indeed, for US imperialism in general.

US imperialism is the top dog – it doesn’t have to make concessions. To the extent that it has, in respect of any commodity, limited internal production facilities in relation to demand, President Trump doesn’t mind letting foreigners fill the shortfall, but it’s only a question of preferring one foreign supplier over another, certainly not a question of putting US producers at a disadvantage.

Thus, the US has a free trade agreement with the EU. It will be happy to deal with the UK instead if it can get better terms, and is hopeful that competition for US trade between Britain and the EU will force both of them to offer more concessions than they would otherwise contemplate.

The Labour party’s Ed Balls, former economic secretary to the Treasury, is among those who are only too aware of where US priorities lie:

“Long-held American ambitions for a UK bilateral deal have not gone away, and include greater access to UK agricultural markets based on lower tariffs and US-style regulation, deregulation of NHS drug pricing and opening up public procurement to US companies. More recently, new issues have also caused friction between the US and UK on digital taxation, 5G procurement and privacy standards.” (The UK is on the horns of a dilemma in US trade talks, Financial Times, 12 May 2020)

Agriculture

What has limited US agribusiness access to European markets has been food safety and animal welfare considerations. GM crops, chlorinated chicken and antibiotic/hormone-saturated beef are all cheap to produce and therefore highly competitive as compared to traditionally produced equivalents. But do we want them?

“Academics point to research published last year [2018] which found washing food in bleach does not kill many of the pathogens that cause food poisoning. Instead, it sends them into a ‘viable but non-culturable state’, which means they are not picked up in standard tests, which take a sample of the food and try to culture any germs on it.

“The presence of the pathogens is thus masked by the bleach, but they are still dangerous to human health.

“Erik Millstone, professor of science policy at Sussex university and co-author of the briefing, told the Guardian lives would be at stake if food based on these lower standards were sold in the UK. ‘I am satisfied [by the evidence] that US food poisoning cases are significantly higher than in the UK. A minority of people suffer fatal complications,’ he said. ‘There will certainly be fatalities, and they typically affect vulnerable people, such as infants, small children and the elderly.’” (Science on safety of chlorinated chicken ‘misunderstood’ by Fiona Harvey, The Guardian,13 September 2019)

Anyone ‘risk adverse’ to eating this meat would share with the Brussels ‘bureaucrats’ the “‘precautionary principle’ and the utopian goal of zero-risk” much berated by Ambrose Evans-Pritchard in his article referred to above, which puts the goal of a trade deal with the US infinitely higher than any trade deal with the European Union.

As for GM crops, Ambrose claims that EU opposition to them “lies behind the pseudo-science of Europe’s ban on GMO crops, a lurch into Stalinist Lysenko obscurantism. The consequence of refusing to tweak genes for better yields is that EU farming relies more on chemicals, just as Europe’s horror of gas fracking and nuclear power cause it to burn more coal.”

However, we are not talking about GM crops in the abstract – we are talking about what is available today; and what is available today has overwhelmingly been developed by US multinationals as a means of increasing their profits, with scant regard for the interests of humanity as a whole.

“Most GM crops fall into one of two categories. They are either engineered to resist chemical herbicides, or they are engineered to produce insecticides in the plants themselves. Herbicide resistant crops increase the use of herbicides [the ‘chemicals’ Ambrose thinks are reduced by GM crops], increasing costs for farmers as well as creating environmental and health problems, affecting poorer communities who live near large GM farms in developing countries, as well as causing pollution.

“Insecticide crops are constantly producing toxins when they’re not even necessary, and can indiscriminately kill other insects beneficial for the environment.” (What’s wrong with GM crops?, Stop the Crop)

In other words, even though the crops themselves are not necessarily unhealthy to eat, the environmental damage they is enormous. Furthermore, the plants do not generate seeds for future crops: causethese have to be purchased from the multinationals in question.

The fact that the multinationals producing the engineered crops operate in a similar way to the tobacco industry when confronted with scientists trying to investigate the dangers of smoking hardly increases confidence in the product.

“Critics often disparage US research on the safety of genetically modified foods, which is often funded or even conducted by GM companies, such as Monsanto …

“Schubert [1] joins Williams [2] as one of a handful of biologists from respected institutions who are willing to sharply challenge the GM-foods-are-safe majority. Both charge that more scientists would speak up against genetic modification if doing so did not invariably lead to being excoriated in journals and the media. These attacks, they argue, are motivated by the fear that airing doubts could lead to less funding for the field. Says Williams: ‘Whether it’s conscious or not, it’s in their interest to promote this field, and they’re not objective.’

“Both scientists say that after publishing comments in respected journals questioning the safety of GM foods, they became the victims of coordinated attacks on their reputations. Schubert even charges that researchers who turn up results that might raise safety questions avoid publishing their findings out of fear of repercussions. ‘If it doesn’t come out the right way,’ he says, ‘you’re going to get trashed.’” (The truth about genetically modified food by David H Freedman, Scientific American, 1 September 203)

In the circumstances, it is not only European governments but also most of the European population who would prefer to play it safe – particularly since the lion’s share of any profits generated by the use of GM crops will land in the greedy grasp of US multinationals.

Finally, as a nation of animal lovers, British people would prefer not to be party to animal husbandry practices of intensive farming so inhumane that they demand extensive use of antibiotics and hormones, as is the practice in the US.

Any use of antibiotics in animals raised for eating is going to result in those antibiotics being passed on to those who consume them and to accelerating the process of generating antibiotic resistant bacteria. And the hormones routinely used to beef up American beef have been linked to an increased risk of breast or prostate cancer:

“The European Union boycotts the US’s hormone-grown beef. The routinely used synthetic hormones zeranol, trenbolone acetate and melengestrol acetate pose ‘increased risks of breast cancer and prostate cancer,’ says the European Commission’s scientific committee on veterinary measures.” (Here’s why most of the meat Americans eat is banned in other industrialised countries by Organic Consumers Association, EcoWatch, 9 July 2017)

The NHS and government procurement

The British government has offered assurances that the NHS and the price of drugs will not be on the table in any US-UK negotiations for a free trade agreement.

It remains to be seen whether the US would accept that. Certainly in deals it has struck with other countries such as south Korea, Mexico and Canada, it has seen to it that such limits as the NHS currently sets to the price it is prepared to pay for drugs from abroad and as to whether it is prepared to use drugs that in the opinion of Nice (National Institute for Health and Care Excellence) do not offer value for money are swept aside, as well as the length of time a patent can be held before expiring.

One can only hope that the British government, in the event that it does conclude a trade deal with the US, will keep its word, as the cost to the NHS of succumbing to what US imperialism would really like is enormous. The single measure of allowing US pharma to prolong its patent rights over drugs would by itself cost billions of pounds.

“Unless you suffer from a debilitating illnesses such as Crohn’s disease or rheumatoid arthritis, you are unlikely to have heard of Humira.” Its generic name is adalimumab, and it is a human monoclonal antibody (or ‘biologic’) that binds and inactivates the inflammatory protein TNF-a.

“That drug, made by the US pharmaceutical company AbbVie, has transformed the lives of thousands of sufferers. It’s also the drug that costs the NHS more than any other – £450m a year …

“Last year, British doctors were allowed to prescribe drugs that do exactly the same job as Humira but at a fraction of the cost. They are known as biosimilars and are the equivalent of generic drugs in relation to chemical drugs. This will save the NHS more than £150m a year, equivalent to the cost of employing thousands of doctors and nurses.

“In the US, the system of intellectual property and patent law means these cheaper drugs can’t be offered to patients until 2023.” (My investigation into a US trade deal shows it really could cost the NHS millions by Antony Barnett, The Guardian, 27 November 2019, our emphasis)

British ‘sovereignty’

An important consideration for very many of those who advocated leaving the European Union and now take a cavalier attitude towards the need to secure a trade deal with that body is the importance of regaining ‘sovereignty’, so that Britain ceases to be a ‘rule taker’.

It is hard to understand why people who are so anxious to preserve British ‘sovereignty’ would seriously contemplate even trying to negotiate a trade deal with the US. That country has signed huge numbers of bilateral trade deals – it prefers bilateral agreements precisely because it is bigger and stronger than the individual countries with which it deals and is therefore in a strong position to impose its terms, however onerous.

US trade deals are pretty much on ‘standard terms’ that put the interests of US multinationals far above the interests of the countries with which they deal. In this context, Britain is a very small fish. US GDP was $21.73tn – between seven and eight times that of the UK in the last quarter of 2019, at $2.824tn. US negotiating strength vis-a-vis the UK is therefore of similar proportions. (US Bureau of Economic Analysis (BEA), Gross Domestic Product)

Among the ‘rule-taking’ that the US will expect to impose on Britain will be a prohibition on dealing with Chinese tech leader Huawei, joining in all the various sanctions regimes that the US unilaterally imposes on governments it does not like, and certainly withdrawing its plans for a digital tax that enables the UK to tax American companies (like Facebook and Google) that make fabulous profits in Britain but pay virtually no tax.

It may even try to impose the nefarious ‘investor state dispute settlement’ (ISDS), “a mechanism in trade deals that enables corporations to challenge, in a secret and parallel judicial system, policies that affect or might affect their profits – even when these policies are specifically designed to protect the public interest …

“In practice, this means corporations can sue governments for doing almost anything they don’t like. Governments have been forced to pay out millions of pounds of taxpayers money to corporations. In talks, although not specifically naming ISDS, the US and UK were revealed to be positively disposed towards strong investor protection.

“All the more concerning is that, right now, experts are anticipating that governments across the world could face a wave of new ISDS cases for the measures that they take to protect life and livelihoods from the threat of coronavirus.” (What’s at stake in a US trade deal?, War on Want, May 2020, our emphasis)

Just what we need! It should be noted that the US has not included ISDS in its trade deal with Canada and has inserted it in a more moderate form in its deal with Mexico. However, in view of the British government’s disposal ‘towards strong investor protection’, it may well be that this will win out over any desire not to be a ‘rule-taker’.

And what does Britain stand to gain from a deal with the US? “The government has projected that the long-run boost to GDP from a UK-US deal is just 0.16 percent, or £3.4bn in today’s money, over the next 15 years.” (Ed Balls et al, op cit)

When one further takes into consideration US imperialism’s propensity unilaterally to withdraw from treaties, agreements and commitments whenever it wants …

Between the devil and the deep blue sea

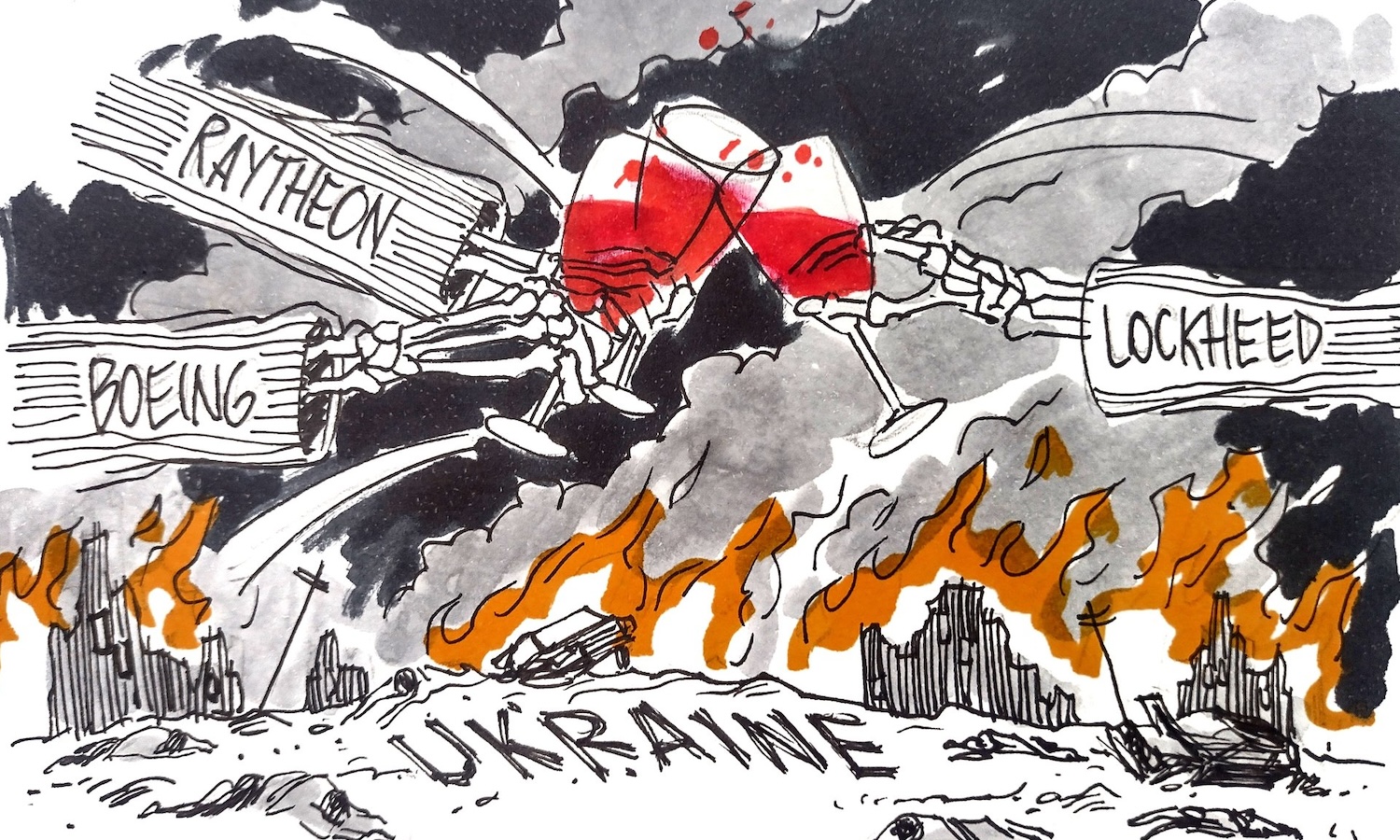

Whether or not Britain is able to reach a trade deal with the European Union, it is undoubtedly the case that its international profiteering interests will have been dealt a severe blow from its withdrawal from the bloodthirsty imperialist EU bloc – a weakening of our class enemy that that is surely to be welcomed.

However, to sign up as an appendage of US imperialism could well prove even worse. China, the world’s second-largest economy, is able, ready and willing to enter into a trade agreement with Britain that would impose no onerous conditions and would genuinely provide a boost to British trade, but, toady of the US that he is, Boris Johnson would not even begin to contemplate negotiating such a deal.

It is clear that there is no advance to be made by workers while the monopoly capitalist ruling class remains in the driving seat. For us, it is socialism or barbarism!

______________________________

NOTES

1. David Schubert, an Alzheimer’s researcher who heads the cellular neurobiology laboratory at the Salk Institute for Biological Studies in La Jolla, California.

2. David H Williams, a cellular biologist from the University of California, Los Angeles.